Audience

Taypayers in the United States can reduce their taxes in a given tax year by claiming a net operating loss deduction. Generally, businesses such as sole proprietors, LLCs, partnerships, S-Corporations and C-Corporations may claim a net operating loss if their combined allowable deductions exceed their taxable income in a given tax year. What this means is that business losses from prior years can offset gains in later years. Its intended purpose is to help businesses survive and invest in growth.

If you receive a 1099 or rental income, you are technically a business and can claim a net operating loss deduction. You do not need to have registered your business if you are operating as a sole proprietorship under your own name.

For example, suppose your business lost money in 2020 and 2021, but had profit in 2022 and 2023. If you accrued a net operating loss in 2020 and 2021, you can claim a net operating loss deduction to reduce your taxable income in 2022 and/or 2023 so that you can pay less tax and possibly be eligible for a refund.

Problem

However, the process for claiming a net operating loss deduction is not straightforward. You will most likely make mistakes if you do it yourself. Even if you try to hire an accountant, most accountants will not want to touch net operating loss calculations.

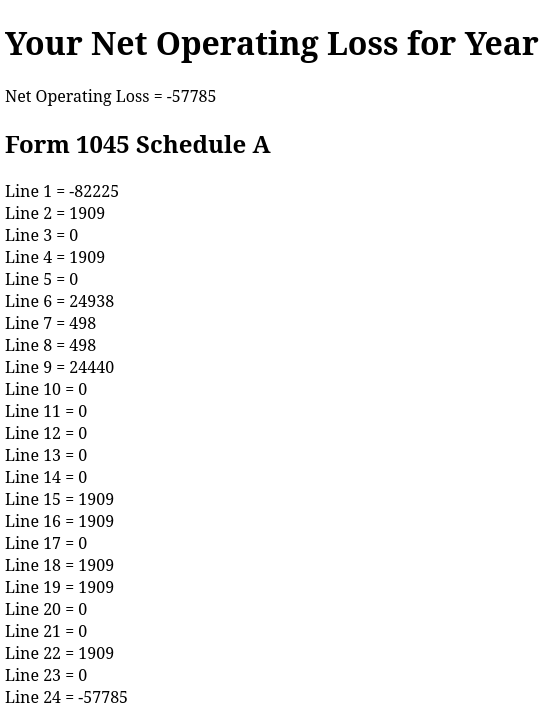

In order for the IRS to accept your net operating loss deduction, you will need to submit Form 1045 Schedule A with your tax return. You will need to submit a separate Form 1045 Schedule A for each year in which you are claiming you had a net operating loss. Be sure to include a detailed letter justifying your calculations.

In the example above, you would have to submit Form 1045 Schedule A for 2020 and 2021 to justify your net operating loss calculations.

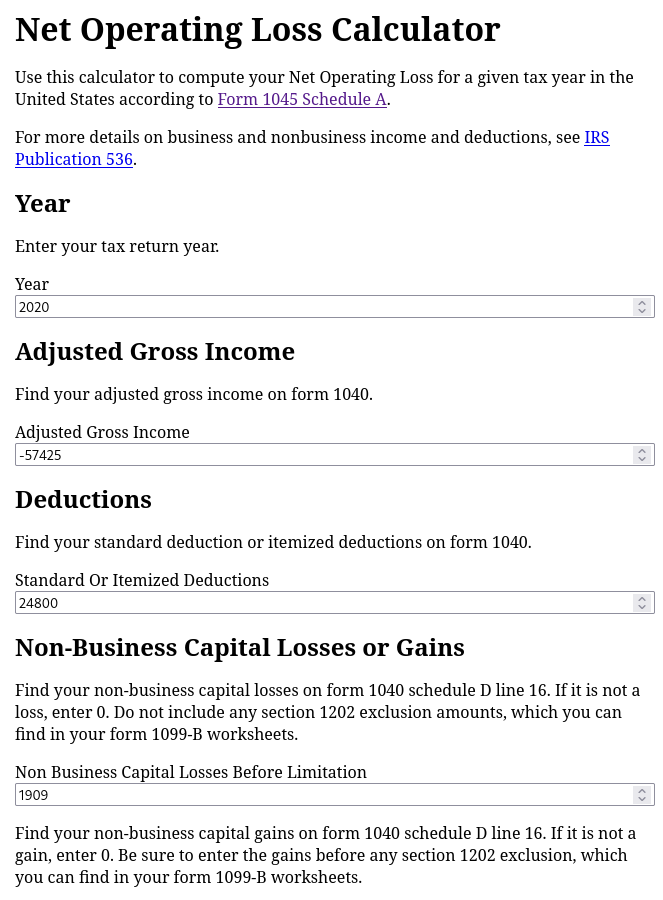

To help you compute your net operating loss, we created a Net Operating Loss Calculator for Individuals. Please note that this calculator is intended for individual tax returns. See Publication 536 for more information on net operating loss for individuals, estates and trusts.

WARNING: If you are trying to calculate net operating loss for a C-Corporation, the tax laws are slightly different. Please contact us at support+requests@crosscompute.com and we’ll make a separate Net Operating Loss Calculator for C-Corporations.

Input

The input variables are taken from Form 1045 Schedule A.

Please note that when computing your Non-Business Deductions, be sure to include your Standard Deduction or Itemized Deductions.

Output

The output variables are the values that you should use to fill Form 1045 Schedule A.

We hope you find our tool useful!